[Latest] US Remittance Market Size/Share Worth USD 16.8 Billion by 2034 at a 12.07% CAGR: Custom Market Insights (Analysis, Outlook, Leaders, Report, Trends, Forecast, Segmentation, Growth Rate, Value, SWOT Analysis)

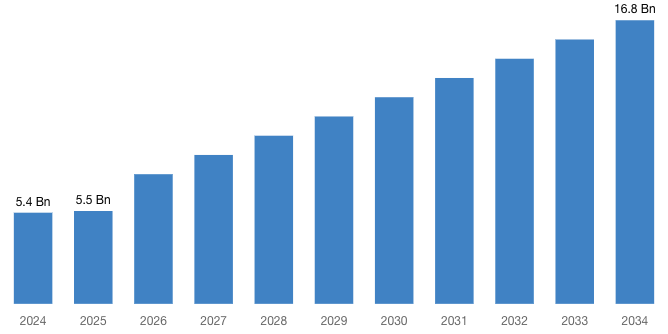

[220+ Pages Latest Report] According to a market research study published by Custom Market Insights, the demand analysis of US Remittance Market size & share revenue was valued at approximately USD 5.4 Billion in 2024 and is expected to reach USD 5.5 Billion in 2025 and is expected to reach around USD 16.8 Billion by 2034, at a CAGR of 12.07% between 2025 and 2034. The key market players listed in the report with their sales, revenues and strategies are MoneyGram International, Western Union, Remitly, Xoom (PayPal), Wise (formerly TransferWise), WorldRemit, OFX, Revolut, Ria Money Transfer, Skrill (Paysafe), Venmo (PayPal), Wells Fargo ExpressSend, Citi Global Transfers, Zelle, Sendwave and others.

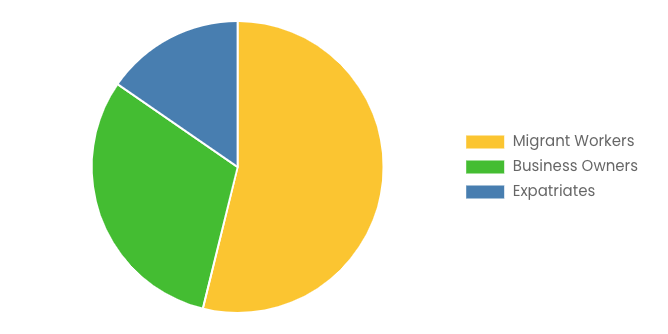

Austin, TX, USA, Aug. 13, 2025 (GLOBE NEWSWIRE) -- Custom Market Insights has published a new research report titled “US Remittance Market Size, Trends and Insights By Service Type (Online Remittance Services, Traditional Remittance Services, Mobile Remittance Services, Cryptocurrency-based Remittance Services), By Sender (Migrant Workers, Business Owners, Expatriates), and By Region - Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034” in its research database.

“According to the latest research study, the demand of the US Remittance Market size & share was valued at approximately USD 5.4 Billion in 2024 and is expected to reach USD 5.5 Billion in 2025 and is expected to reach a value of around USD 16.8 Billion by 2034, at a compound annual growth rate (CAGR) of about 12.07% during the forecast period 2025 to 2034.”

Click Here to Access a Free Sample Report of the US Remittance Market @ https://www.custommarketinsights.com/request-for-free-sample/?reportid=72018

Overview

According to a senior analyst with CMI Research, the U.S. remittance market will dramatically transform as a result of new digital-first solutions, as well as blockchain-based remittances that will challenge traditional methods used by migrants, expatriates, and entrepreneurs for cross-border transfers. The potential efficiencies—expanded due to regulatory modernization, new crypto corridors, and embedded digital financial tools—will hopefully develop into new marketplaces through 2034r payments. Through 2034, we expect regulatory modernization, new crypto corridors, and embedded digital financial tools to introduce new efficiencies and potential market offerings.

Key Trends & Drivers

- Steady Increase in Migration and Global Workforce Mobility: Migration is still a significant consumer macro driver in the remittance ecosystem. The United States has always been one of the key destinations for migrants from across the globe. Consequently, the millions of workers still in the States sending money back home will inevitably support family members back in their countries of origin, namely Latin America, Asia, Africa, and the Caribbean. For example, remittance flows between Mexico and the U.S. and India and the U.S. in 2023 were at an all-time high, which indicates that remittance payments serve as an important source of support for many developing economies.

- Accelerated Adoption of Mobile and Digital Remittance Solutions: Cash transfers are being replaced with mobile-first applications and web-based remittance solutions. Companies such as Wise, Remitly, WorldRemit, and Xoom are leading in this space by providing fee transparency, competitive exchange rates, and real-time tracking. The ubiquity of smartphones globally, even within low-income migrant communities, enables direct P2P flows without having to rely on an agent-dependent network.

Request a Customized Copy of the US Remittance Market Report @ https://www.custommarketinsights.com/request-for-customization/?reportid=72018

- Blockchain and Cryptocurrency-supported Cross-border Transfers: The emergence of crypto-supported next-generation rail systems, such as RippleNet corridors and stablecoin-supported transfers, offers faster and more cost-effective solutions than wire systems. In addition, these blockchain channels employ numerous intermediaries as well as foreign exchange conversion costs, enabling almost instant settlements. The speed of settlement and predictability provided by blockchain, in these scenarios, are essential for migrant workers.

- Expanding Access to Digital Financial Services in Developing Markets: More recipients are opening mobile wallets and digital bank accounts with trusted organizations in their home countries, allowing recipients of U.S.-origin remittances to increasingly receive funds directly into their mobile or digital wallets. This financial inclusion in rural areas can ‘jump start’ inclusivity, where access to financial services is limited.

- A Supportive Regulatory Environment: Efforts to support the UN SDGs to lower global remittance transaction fees below 3% have created a more supportive regulatory environment. In the U.S., trusted anti-money laundering and know-your-customer regimes and compliance frameworks help to restore trust in the consumer environment, which has allowed fintech ideas to gain legitimacy and advance.

Report Scope

| Feature of the Report | Details |

| Market Size in 2025 | USD 5.5 Billion |

| Projected Market Size in 2034 | USD 16.8 Billion |

| Market Size in 2024 | USD 5.4 Billion |

| CAGR Growth Rate | 12.07% CAGR |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Key Segment | By Service Type, Sender and Region |

| Report Coverage | Revenue Estimation and Forecast, Company Profile, Competitive Landscape, Growth Factors and Recent Trends |

| Country Scope | US |

| Buying Options | Request tailored purchasing options to fulfil your requirements for research. |

(A free sample of the US Remittance report is available upon request; please contact us for more information.)

Our Free Sample Report Consists of the following:

- Introduction, Overview, and in-depth industry analysis are all included in the 2024 updated report.

- The COVID-19 Pandemic Outbreak Impact Analysis is included in the package.

- About 220+ Pages Research Report (Including Recent Research)

- Provide detailed chapter-by-chapter guidance on the Request.

- Updated Regional Analysis with a Graphical Representation of Size, Share, and Trends for the Year 2025

- Includes Tables and figures have been updated.

- The most recent version of the report includes the Top Market Players, their Business Strategies, Sales Volume, and Revenue Analysis

- Custom Market Insights (CMI) research methodology

(Please note that the sample of the US Remittance report has been modified to include the COVID-19 impact study prior to delivery.)

Request a Customized Copy of the US Remittance Market Report @ https://www.custommarketinsights.com/report/us-remittance-market/

Regional Perspective

- US: The US–Mexico corridor is the largest in the world, with over $60 billion sent in 2023, much of which is going to help families with basic needs. Cash pickup remains the dominant payment method, but that is beginning to shift toward increased digital wallets.

SWOT Analysis

Strengths

- Plentiful supply of migrant workers and expat professionals: The U.S. has millions of migrant workers and expat professionals who remit money month in and month out. These consistent flows connect families across borders regardless of economic conditions. Families rely on remittances for food, education, and emergencies. This constant demand for remittances creates a robust market and keeps remittances fluid.

- A Mature Digital Payments Ecosystem: The United States has an advanced digital payment system that is widely used. The U.S. has made practical use of online, mobile, and crypto methods for everyday remittances. Senders get a clear fee structure, faster settlement times, and a frictionless onboarding. The easier it is for a digital financial service fintech to send money, the more companies are trying to lower the cost and be more credible, reliable, and trustworthy to customers and help families use more digital ways to send money instead of costly, untrusted traditional cash entry points.

Weakness

- Dependence on Cash Among low-income Senders: Many low-income migrants continue to use cash and physical agents instead of digital channels due to low digital literacy, trust, or access to banking. This reliance has costs associated with it and excludes them from financial inclusion, and cash dependency is a problem that needs to be addressed through education, community initiatives, and easily accessible online digital options in lieu of cash.

- High Costs of legacy Agent Networks: Traditional providers of remittances use heavy investments to create a large, costly network of physical agents to offer cash payouts, particularly in rural and unbanked areas. Managing a network of agents will only continue to increase operational costs and result in fees that are higher than those of a digital remittance service. Legacy companies have to not only incur overhead to keep the physical agent network but also will have increasing competition from leaner tech companies that use tech to lower costs. The potential to show growth and remain competitive from a fee perspective is diminishing for a traditional remittance service.

Request a Customized Copy of the US Remittance Market Report @ https://www.custommarketinsights.com/report/us-remittance-market/

Key questions answered in this report:

- What is the size of the US remittances market, and what is its expected growth rate?

- What are the primary driving factors that push the US Remittance market forward?

- What are the US Remittance Industry's top companies?

- What are the different categories that the US Remittance Market caters to?

- What will be the fastest-growing segment or region?

- In the value chain, what role do essential players play?

- What is the procedure for getting a free copy of the sample report on the US remittance market and company profiles?

Key Offerings:

- Market Share, Size & Forecast by Revenue | 2025−2034

- Market Dynamics – Growth Drivers, Restraints, Investment Opportunities, and Leading Trends

- Market Segmentation – A detailed analysis by Types of Services, by End-User Services, and by regions

- Competitive Landscape – Top Key Vendors and Other Prominent Vendors

Buy this Premium US Remittance Research Report | Fast Delivery Available - [220+ Pages] @ https://www.custommarketinsights.com/report/us-remittance-market/

Opportunity

- Blockchain to Save Money and Speed Settlement: Blockchain can enable a direct, peer-to-peer transaction without using banks and the FX markups that always get hidden in the rate. This provides the potential for cheaper, faster, and more transparent international transfers. For money transfers with very high fees to begin with, blockchain can provide significant savings and value for senders of money, especially in underserved remittance markets.

- Mobile Adoption Broadens Access: The use of mobile wallets is growing quickly in Africa, Asia, and Latin America. There are potentially millions of people gaining access to financial services who do not have a bank account. A U.S. migrant can now send money directly to a mobile wallet, eliminating the same costs of money transfer via cash agents and yielding faster delivery time while increasing financial inclusion for remote communities.

Threats

- Cyber Risks and Fraud: Online remittances are becoming more prevalent as such, the presence of fraud, identity theft, and cyber risks that come with it is increasing as well. If a provider suffers even one security breach, seconds of lost trust for first-time digital users can take years to rebuild. Increasing and improving fraud detection, using encryption, and having systemic cybersecurity structures in place are critical to protecting transactions and creating and maintaining user confidence.

- Inconsistent and Unpredictable Crypto Regulation: Remittances powered by cryptocurrency are promising savings and speed. However, regulations surrounding cryptocurrency that allow for use in remittances are inconsistent and unpredictable worldwide. Any last-minute regulatory changes, restrictions, or crackdowns could shutter a remittance channel using cryptocurrency overnight. If they are using blockchain, they must have the ability to shift quickly and be fully compliant with any regulation to avoid legal problems, which would inhibit their ability to keep cross-border corridors open.

Request a Customized Copy of the US Remittance Market Report @ https://www.custommarketinsights.com/report/us-remittance-market/

(We customized your report to meet your specific research requirements. Inquire with our sales team about customizing your report.)

Still, Looking for More Information? Do OR Want Data for Inclusion in magazines, case studies, research papers, or Media?

Email Directly Here with Detail Information: support@custommarketinsights.com

Browse the full “US Remittance Market Size, Trends and Insights By Service Type (Online Remittance Services, Traditional Remittance Services, Mobile Remittance Services, Cryptocurrency-based Remittance Services), By Sender (Migrant Workers, Business Owners, Expatriates), and By Region - Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034” Report at https://www.custommarketinsights.com/report/us-remittance-market/

List of the prominent players in the US Remittance Market:

- MoneyGram International

- Western Union

- Remitly

- Xoom (PayPal)

- Wise (formerly TransferWise)

- WorldRemit

- OFX

- Revolut

- Ria Money Transfer

- Skrill (Paysafe)

- Venmo (PayPal)

- Wells Fargo ExpressSend

- Citi Global Transfers

- Zelle

- Sendwave

- Others

Click Here to Access a Free Sample Report of the US Remittance Market @ https://www.custommarketinsights.com/report/us-remittance-market/

Spectacular Deals

- Comprehensive coverage

- Maximum number of market tables and figures

- The subscription-based option is offered.

- Best price guarantee

- Free 35% or 60 hours of customization.

- Free post-sale service assistance.

- 25% discount on your next purchase.

- Service guarantees are available.

- Personalized market brief by author.

Browse More Related Reports:

Internet of Medical Things IoMT Market: Internet of Medical Things IoMT Market Size, Trends and Insights By Offering Type (General Purpose Reloadable Card, Gift Cards, Incentive/Payroll Card, Others), By Card Type (Closed Loop Prepaid Card, Open Loop Prepaid Card), By End User Industry (Retail, Healthcare, Travel and Hospitality, Others), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034

Prepaid Gift Card Market: Prepaid Gift Card Market Size, Trends and Insights By Offering Type (General Purpose Reloadable Card, Gift Cards, Incentive/Payroll Card, Others), By Card Type (Closed Loop Prepaid Card, Open Loop Prepaid Card), By End User Industry (Retail, Healthcare, Travel and Hospitality, Others), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034

Digital Personalized Nutrition Market: Digital Personalized Nutrition Market Size, Trends and Insights By Purchase Model (Subscription, One Time Purchase), By End-Users (Direct Consumers, Wellness & Fitness Centers, Hospitals & Clinics, Institutions), By Application (Generic Health & Fitness, Disease-Based, Sports Nutrition), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034

US Fleet Management Market: US Fleet Management Market Size, Trends and Insights By Deployment Type (On-demand, On-Premises), By Vehicle Type (Commercial Fleets, Passenger Cars), By Technology (Commercial Telematics Hardware, Software, Connectivity Technologies), and By Region - Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034

Europe Fleet Management Market: Europe Fleet Management Market Size, Trends and Insights By Deployment Type (On-demand, On-Premises), By Vehicle Type (Commercial Fleets, Passenger Cars), By Technology (Commercial Telematics Hardware, Software, Connectivity Technologies), and By Region - Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034

Software Supply Chain Security Market: Software Supply Chain Security Market Size, Trends and Insights By Component (Hardware, Software, Services), By Security Type (Data Protection, Data Visibility and Governance, Other Security Types), By Enterprise Size (Large Enterprises, Small and Medium-Sized Enterprises (SMEs)), By Vertical (Healthcare and Pharmaceuticals, Retail and E-commerce, Automotive, Transportation and Logistics, Manufacturing, Other Verticals), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025 – 2034

GCC 5G Services Market: GCC 5g Services Market Size, Trends and Insights By Communication Type (Massive Machine-type Communications (mMTC), Ultra-reliable and Low Latency Communications (uRLLC), Enhanced Mobile Broadband (eMBB), Fixed Wireless Access (FWA)), By Industry (Healthcare, Transport and Logistics, Automotive, Media and Entertainment, IT and Telecom, Others), By End User (Enterprises, Individual), and By Region - Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025 – 2034

Refurbished IT Asset Disposition Market: Refurbished IT Asset Disposition Market Size, Trends and Insights By Asset Type (Computers/Laptops Disposition, Servers Disposition, Mobile devises Disposition, Storage devises Disposition), By End User (Banking, Financial Services, and Insurance (BFSI), IT and Telecom, Educational Institutions, Healthcare Industry, Manufacturing, Media and Entertainment, Others), and By Region - Global Industry Overview, Statistical Data, Competitive Analysis, Share, Outlook, and Forecast 2025–2034

The US Remittance Market is segmented as follows:

By Service Type

- Online Remittance Services

- Traditional Remittance Services

- Mobile Remittance Services

- Cryptocurrency-based Remittance Services

By Sender

- Migrant Workers

- Business Owners

- Expatriates

Click Here to Get a Free Sample Report of the US Remittance Market @ https://www.custommarketinsights.com/report/us-remittance-market/

This US Remittance Market Research/Analysis Report Contains Answers to the following Questions.

- Which Trends Are Causing These Developments?

- Who Are the Key Players in This US Remittance Market? What are the company profiles, product information, and contact details for these key players?

- What Was the Market Status of the US Remittance Market? What Was the Capacity, Production Value, Cost and PROFIT of the US Remittance Market?

- What Is the Current Market Status of the US Remittance Industry? What is the market competition in this industry, both at the company level and by country? What's Market Analysis of US Remittance Market by Considering Applications and Types?

- What Are Projections of the US Remittance Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about imports and exports?

- What Is US Remittance Market Chain Analysis by Upstream Raw Materials and Downstream Industry?

- What Is the Economic Impact On US Remittance Industry? What are Macroeconomic Environment Analysis Results? What Are Macroeconomic Environment Development Trends?

- What Are Market Dynamics of US Remittance Market? What Are Challenges and Opportunities?

- What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for US Remittance Industry?

Click Here to Access a Free Sample Report of the US Remittance Market @ https://www.custommarketinsights.com/report/us-remittance-market/

Reasons to Purchase US Remittance Market Report

- US Remittance Market Report provides qualitative and quantitative analysis of the market based on segmentation involving economic and non-economic factors.

- US Remittance Market report outlines market value (USD) data for each segment and sub-segment.

- This report indicates the region and segment expected to witness the fastest growth and dominate the market.

- US Remittance Market Analysis by geography highlights the consumption of the product/service in the region and indicates the factors affecting the market within each region.

- The competitive landscape includes the market rankings of major players, as well as new service and product launches, partnerships, business expansions, and acquisitions made by the profiled companies in the past five years.

- The report includes extensive company profiles, which include company overviews, insights, product benchmarking, and SWOT analyses for the major market players.

- The Industry's current and future market outlook concerning recent developments (which involve growth opportunities and drivers as well as challenges and restraints of both emerging and developed regions.

- US Remittance Market Includes in-depth market analysis from various perspectives through Porter's five forces analysis and provides insight into the market through Value Chain.

Reasons for the Research Report

- The study provides a thorough overview of the US Remittance market. Compare your performance to that of the market as a whole.

- Aim to maintain competitiveness while innovations from established key players fuel market growth.

Buy this Premium US Remittance Research Report | Fast Delivery Available - [220+ Pages] @ https://www.custommarketinsights.com/report/us-remittance-market/

What does the report include?

- Drivers, restrictions, and opportunities are among the qualitative elements covered in the worldwide US Remittance market analysis.

- The competitive environment of current and potential participants in the US Remittance market is covered in the report, as well as those companies' strategic product development ambitions.

- This study conducts a qualitative and quantitative analysis of the market based on the component, application, and industry vertical. Additionally, the report provides comparable data for the key regions.

- The report provides actual market sizes and forecasts for each segment mentioned above.

Who should buy this report?

- Participants and stakeholders worldwide US Remittance market should find this report useful. The research will be useful to all market participants in the US Remittance industry.

- Managers in the US Remittance sector are interested in publishing up-to-date and projected data about the worldwide US Remittance market.

- Governmental agencies, regulatory bodies, decision-makers, and organizations want to invest in US Remittance products' market trends.

- Analysts, researchers, educators, strategy managers, and government organizations seek market insights to develop their plans.

Request a Customized Copy of the US Remittance Market Report @ https://www.custommarketinsights.com/report/us-remittance-market/

About Custom Market Insights:

Custom Market Insights is a market research and advisory company delivering business insights and market research reports to large, small, and medium-scale enterprises. We assist clients with strategies and business policies and regularly work towards achieving sustainable growth in their respective domains.

CMI provides a one-stop solution for data collection to investment advice. The expert analysis of our company digs out essential factors that help to understand the significance and impact of market dynamics. The professional experts apply clients inside on the aspects such as strategies for future estimation fall, forecasting or opportunity to grow, and consumer survey.

Follow Us: LinkedIn | Twitter | Facebook | YouTube

Contact Us:

Joel John

CMI Consulting LLC

1333, 701 Tillery Street Unit 12,

Austin, TX, Travis, US, 78702

USA: +1 737-734-2707

India: +91 20 46022736

Email: support@custommarketinsights.com

Web: https://www.custommarketinsights.com/

Blog: https://www.techyounme.com/

Blog: https://businessresearchindustry.com

Blog: https://www.technowalla.com/

Blog: https://marketresearchtrade.com/

Buy this Premium US Remittance Research Report | Fast Delivery Available - [220+ Pages] @ https://www.custommarketinsights.com/report/us-remittance-market/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.